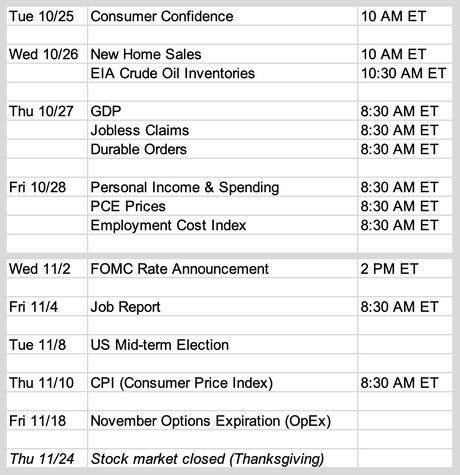

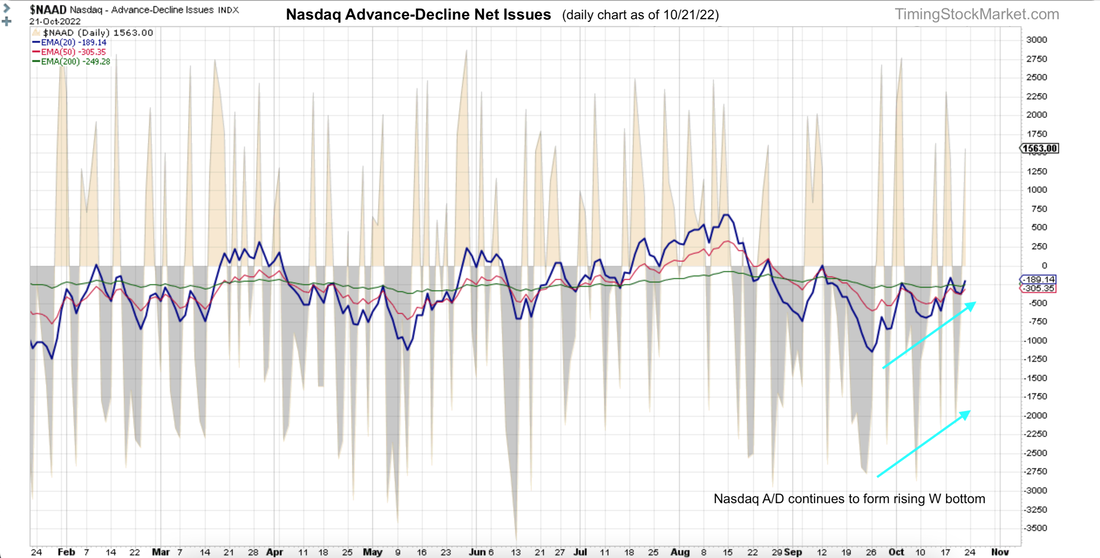

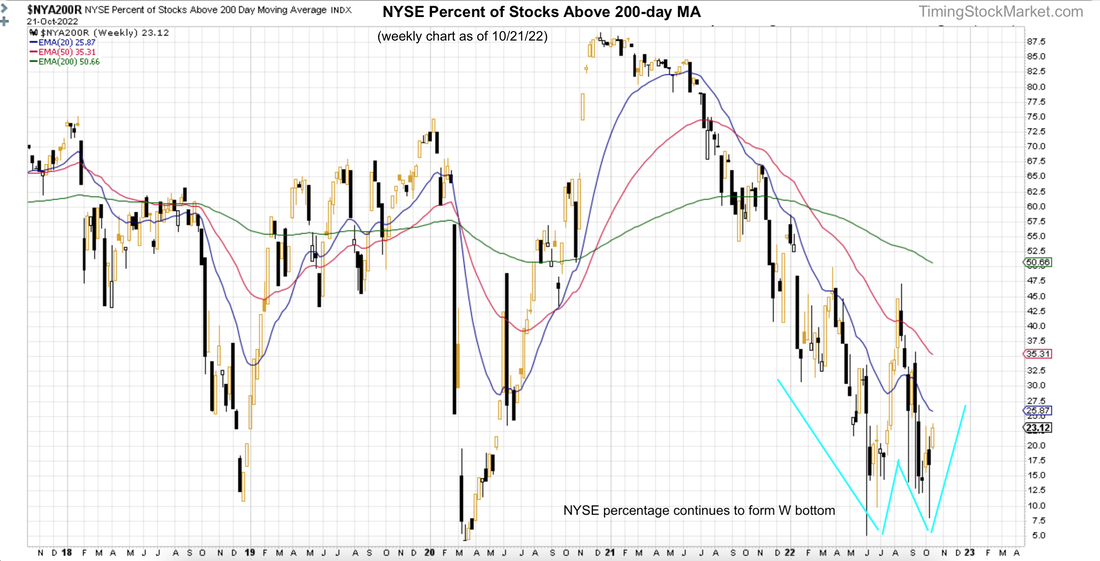

Updates 2:12 PM ET - Monday 10/24/22 Bullish but $VIX needs to stay below 31 Conditions are still bullish in the short term, but $VIX needs to stay below 31 an start to head down below 29 soon. If $VIX starts to base between 29 and 30 and inches up from there, then it may make a serious attempt to climb up to 33 - 34. This climb would trigger bigger drops in ES NQ RTY, where we may see ES tests 3600 again. In that bearish scenario, TNA would drop back down to 28 or lower. Therefore, we will aggressively tighten stop on our TNA runner position if $VIX starts to base in the 29 - 30 zone. There is no low-risk bullish setup right now to re-enter TNA swing position, so we're holding that capital in cash for now. Updates 12:30 AM ET - Monday 10/24/22 Upcoming key events Thursday GDP and Friday PCE reports will add fresh data to the state of inflation and economic growth, ahead of FOMC rate announcement next Wednesday 11/2. Earnings releases this week Chart courtesy of Earnings Whispers. This is a big week for tech earnings: Microsoft and Alphabet on Tuesday, Meta on Wednesday, Amazon and Intel on Thursday. Why did stocks rise on Friday? Global macro economic conditions are still very bleak, yet ES NQ RTY sharply rose last week. Why? One theory says the bullish rise was due to dovish comments by a couple Fed officials, and a WSJ article that many traders are guessing to be trial balloon by the Fed: One possible solution would be for Fed officials to approve a half-point increase in December, while using their new economic projections to show they might lift rates somewhat higher in 2023 than they projected last month. Another theory is that it's just the result of large number of puts expiring on OpEx Friday. As the previously sold puts expire, dealers who hedged these sold puts by shorting stock futures had to cover their shorts as price started to rise. All of this happened at a very large scale, and resulted in a massive short squeeze. We suspect that both of these events functioned as catalysts. They were the match that lit the pile of dried wood on Friday. But this bullish pile of dried wood has been building for some time if you recall. The evidence has been showing up in the rising market breadth (since 9/30) and declining volatility (since 10/12). So by tracking breadth and volatility in addition to price actions, we were able to anticipate the growing bullish setup that took off on Friday. And now we need to examine them again. Market breadth is still very supportive of stocks

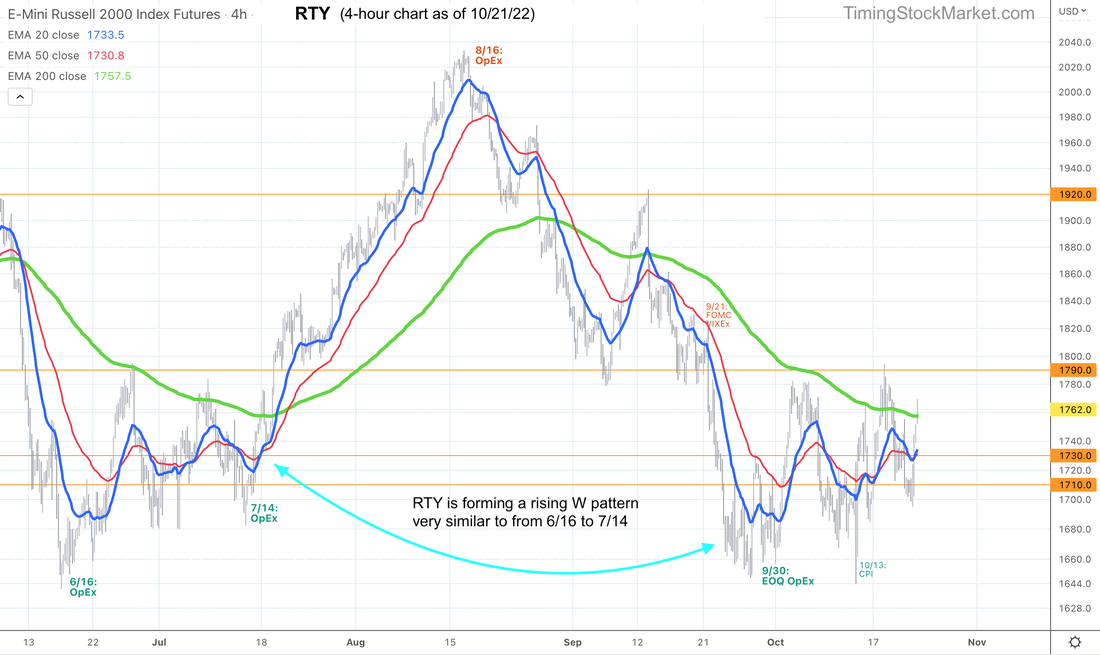

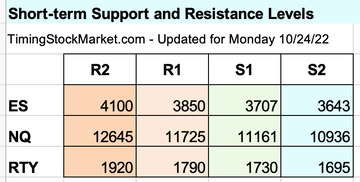

Volatility is still declining $VIX 200-hour EMA green line in the hourly chart below has been going sideway all of last week. Meanwhile, $VIX 20-hour blue line and 50-hour red line have been steadily marching down. They are now both below the green line. As long as this condition remains true, $VIX is very supportive of stocks. Keep in mind though that $VIX may pop back up quickly to retest the zone 31- 32 one more time before it continues the march downward. $VIX may get down to 25 before this rally is over. RTY has formed W bottom similar to mid June Key S/R levels On Monday, we may see ES NQ RTY dip back into the zone between S1 and S2 while $VIX pops up possibly to retest 31-32. Trade plan Right after open on Friday, we sent out a series of alert as soon as we noticed that $VIX was continuing to drop and ES NQ RTY were turning bullish at opening. We manually scaled into TNA runner and swing positions. When ES NQ RTY opened on Sunday (6 PM ET), they all rose straight up. ES tagged 3813 before dropping rather sharply. We suspect that ES NQ RTY are going to tag these price levels again near open on Monday (9:30 AM ET).

Then we may see an intraday pullback before the climb resumes. We plan to tighten the stop on TNA swing position to lock in some partial profit. But we'll leave the stop at breakeven for TNA runner and give that position a chance to grow. Note that we plan to re-enter TNA swing position during the pullback. Buy orders for this will be posted as we get more data. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed