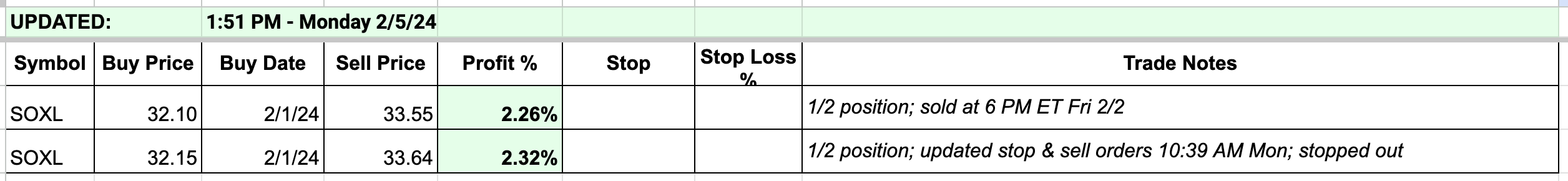

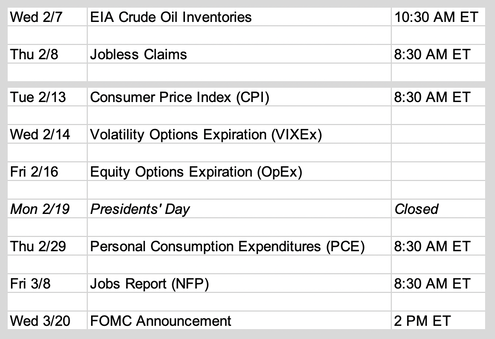

Updates 4 PM ET - Monday Exited SOXL We manually took profit on half of our SOXL position ahead of the weekend, and got stopped out of the remaining half today for a gain of 4.5% total. See the original entry here. Updates 2:45 PM ET - Sunday Upcoming key events This week is much lighter in news and announcements so traders can take a break to get ready for next week's excitement. Read more economic analysis here. Big picture: bull market; short term: dip possible The bull trend continues, but the indicators also continue to suggest that there's bearishness building up under the hood. This is likely to lead to a dip (not a bear market). The question is how big and how long will this dip be. The indicators cannot tell us that right now, so we simply have to monitor price behaviors at key S/R levels for ES NQ RTY. Volatility rising VIX 4-hour chart below shows a flat sideway 200 EMA green line, and a coiling and rising 20 EMA blue line. This combination resulted in VIX surge back in March and August through October last year (see red arrows below). There is a good chance that this surge will happen again so bulls should protect profits here. Breadth declining S&P and Nasdaq Advance-Decline Percents (Stockcharts $SPXADP $NDXADP) continue to show lower high topping patterns on their daily charts. They support the possibility of ES NQ RTY dipping to test key support levels. McClellan Oscillator for both NYSE and Nasdaq (Stockcharts $NYMO $NAMO) are back in negative territory. They confirm the above bearish messages. Rates rising After the hot job report on Friday, yields all rose sharply (US10Y; US20Y; US02Y). Junk bonds (JNK HYG) have been signaling bond selling by forming same high multi-tops since December 28. Key S/R levels NQ: Despite the messages from VIX and market breadth, NQ failed to drop to key support at 17000 after FOMC announcement. The failed signal gave it a strong push back up, and by Friday NQ is back up near the key resistance level of 17794. This level has generated three short term tops at this point, so don't be surprised if NQ spends multiple days this week chopping in this zone between 17475 and 17794. CPI report on February 13 will likely be the catalyst to either pop NQ up from this chop zone, or drop NQ down from this chop zone. Note that we are not anticipating fresh multi-week breakout or breakdown. Rather, if NQ rises out of this zone, it is likely to run into short-term top at 18000 ahead of OpEx. If NQ drops from this zone, it is likely to find buyer support at 17000 to resume the bullish climb. ES: Like NQ, ES failed to drop to key support at 4840 after FOMC announcement. The failed signal gave ES a strong push back up. ES is likely to spend this week digesting the gain. Look for ES to spend multiple days this week chopping in the zone between 4930 and 4997. CPI report on February 13 may be the catalyst to push ES up to short-term top at 5040 ahead of OpEx. If CPI results in bearish response instead, ES may drop from the chop zone down to 4840 before resuming the bullish climb. RTY: RTY has been dropping and is likely to continue doing so for the early part of this week. Its chop zone is 1940 - 1987. CPI report on February 13 may be the catalyst to push RTY up to short-term top at 2050 ahead of OpEx. If CPI results in bearish response instead, RTY may drop from the chop zone down to 1890. Our personal trade plan We bought SOXL on Thursday after seeing the failure to drop signal. We collected profit on 1/2 position on Friday because the bearish messages from the indicators made us nervous. We are still holding the other half of SOXL to reach sell target. Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed