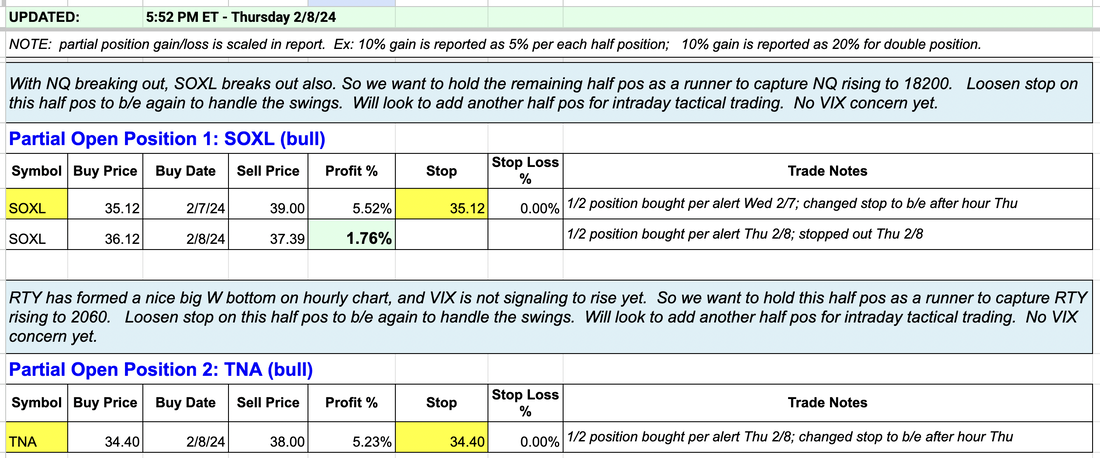

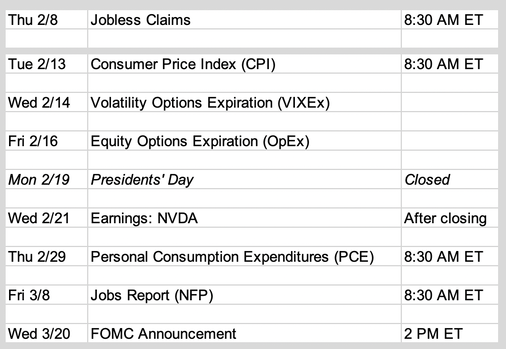

Updates 7:25 PM ET - Thursday Traded SOXL and TNA 1. Bull Quick Profit SOXL: Today we did an intraday tactical trade and collected a small profit on half position of SOXL. 2. Bull Runner SOXL: On Wednesday Feb 7, we entered a half position of SOXL when NQ started breaking out. We continue to hold this as a runner to capture NQ rising to 18200. 3. Bull Runner TNA: Today we re-entered a half position of TNA when RTY formed a big W bottom on its hourly chart. We plan to hold this as a runner to capture RTY rising to 2060. Big picture: bull market; short-term: strong buying momentum returns On its 4-hour chart, VIX 20 EMA blue line just crossed below its 200 EMA green line. This is bullish for equity, even if it's just short term. On their hourly charts S&P and Nasdaq Advance-Decline Percents (Stockcharts $SPXADP $NDXADP) continue to form W bottom. This implies at least a short-term rise for ES and NQ. McClellan Oscillator for both NYSE and Nasdaq (Stockcharts $NYMO $NAMO) both are forming W bottom on their daily charts via their 20-day EMA lines. This implies at least a short-term rise for ES and NQ. 10-year yield (US10Y) is basing. It may rise from here, but the basing process is going to take some time and meanwhile yield is likely to drop short term. Key S/R levels NQ has broken out above resistance at 17775. While it may quickly dip to retest 17725 on Thursday, NQ will march up and will reach 18000 soon. NQ may even reach 18200 by OpEx. Short-term support lies at 17475. ES has broken out above resistance at 5000. While it may quickly dip to retest 5000 on Thursday, ES will march up and will reach 5040 soon. NQ may even reach 5075 by OpEx. Short-term support lies at 4980. RTY is likely to retest 1925 again. If it finds enough support here, it will form a W bottom for a big rise up to 2060 eventually. However, if RTY drops below 1905, then selling will accelerate and can drop RTY down to key support at 1835. Our personal trade plan Bull position 1: We entered a half position of SOXL when NQ started breaking out. We look to add the remaining half SOXL on Thursday. Bull position 2: We tested the bullish rise in TNA when RTY found support at the morning low. However, after hour price actions showed RTY likely to test 1925 again. This means TNA is likely to retest 32.7. So we exited TNA to possibly re-enter at a lower price on Thursday. Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed