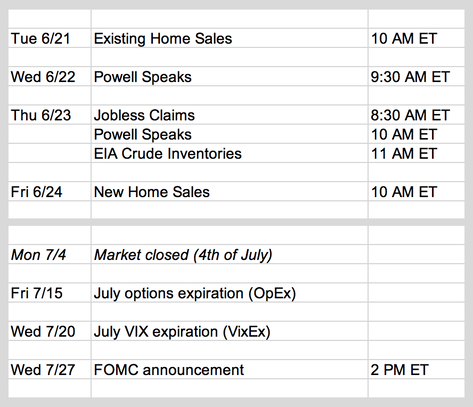

Updates 12:45 PM ET - Monday Upcoming key events After all the events of last week, market participants were psychologically exhausted going into the long weekend. This coming week is much lighter in economic reports, but Powell is scheduled to speak on Wednesday and Thursday. Some potential fireworks there. Short-term: Bear market is not done, but it is getting a respite Despite the Fed's latest attempt at soft landing, this bear market is not done yet. But it would appear that there is a bit of a respite happening after the major sell-off right before FOMC last week.

Nasdaq percentage of stocks above 200-day MA dropped as low as 4% last week, before recovering to form a bullish doji on its weekly chart. It closed at 8%, certainly down in the range of capitulation. But the charts are not sending out a clear "capitulated" message just yet. Long term: $SPX to 3000 and then 6000? All of this is very depressing news for most people. But you may cheer at the following projections. One of the most bearish analyst on Wall Street, Michael Hartnett, came out with some interesting predictions for this bear market. Essentially, based on historical data:

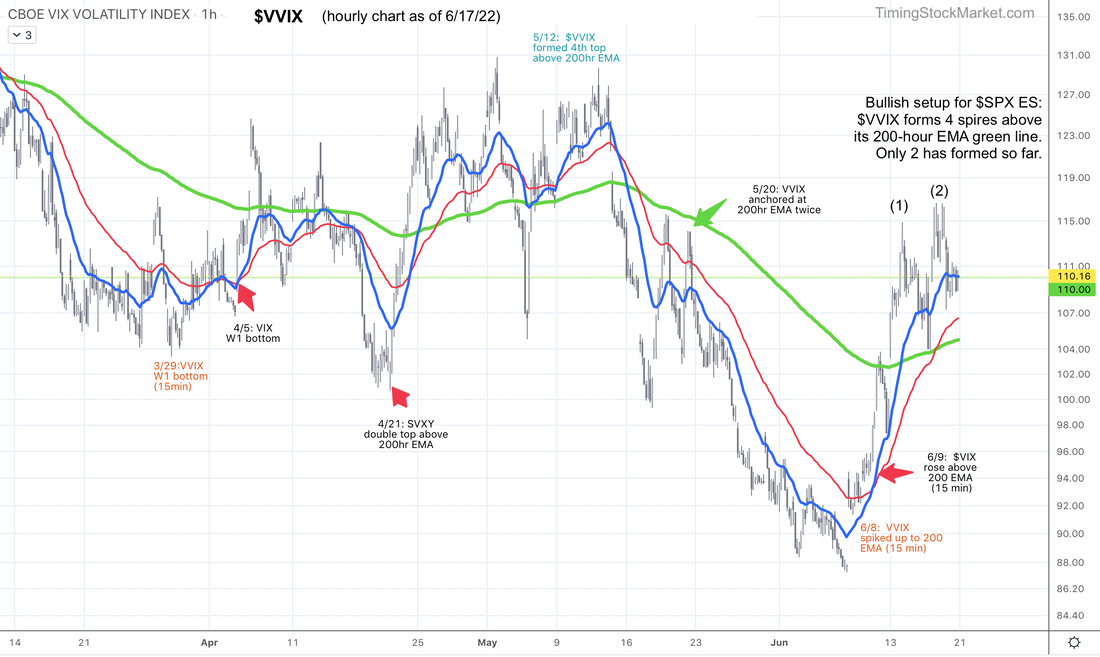

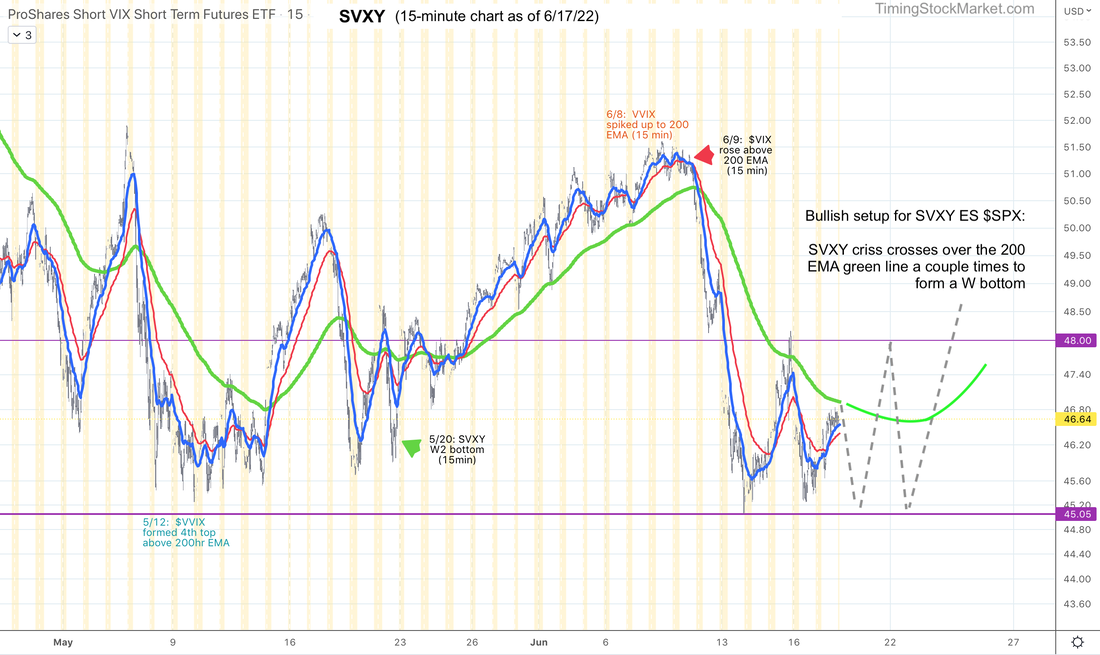

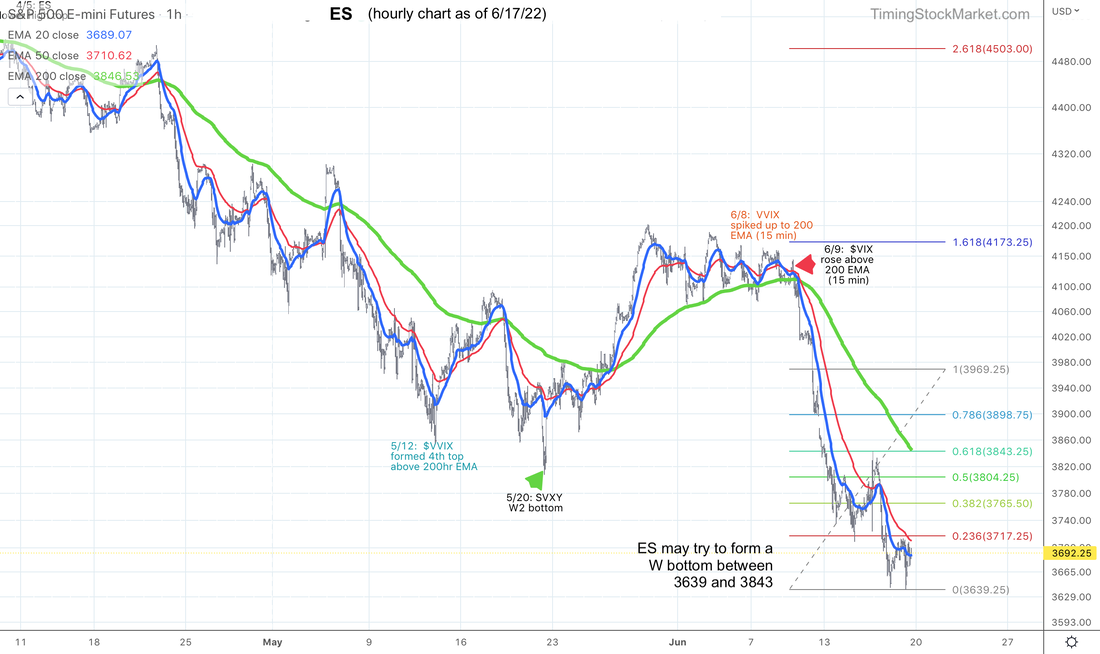

Short-term volatility signal: "Transition" Zooming back into the short-term tactical trading perspective, we focus once again on the keeper of the market rhythm: $VVIX, otherwise known as "vol of vol". So far in this bear market, when $VVIX has formed 4 topping spires is when the volatility signal becomes "Approaching Bullish". Then when $VVIX drops below it 200-hour EMA, rises back up and tags this key resistance, volatility signal becomes"Fully Bullish". We don't have that setup with $VVIX yet. $VVIX has only formed 2 spires so far. But in case we're wrong about this projection, we are also going to track it via SVXY. Key S/R levels While SVXY forms W bottom, here are the key S/R levels to monitor.

Trade plan Click here for live trades. Subscribe to get our latest analysis, daily trade plans and live intraday trades. Current trade record here. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed