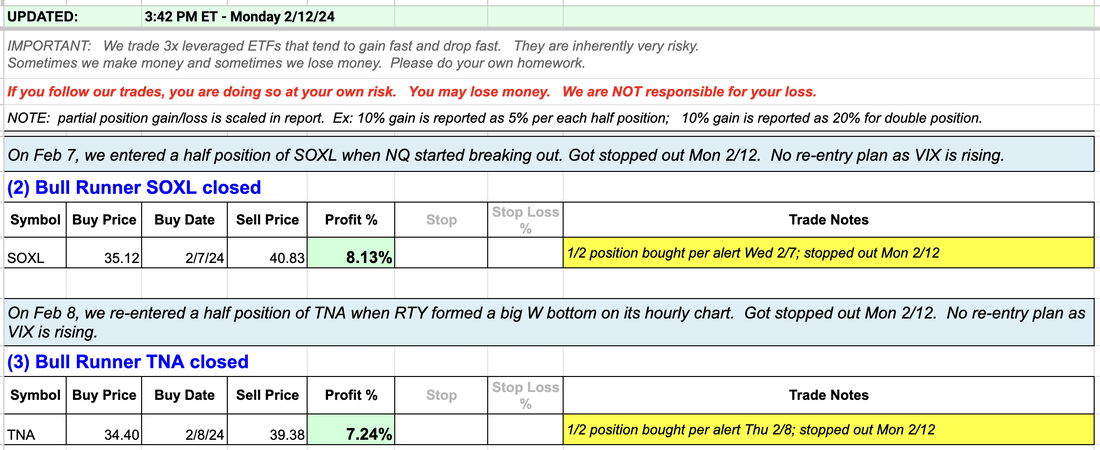

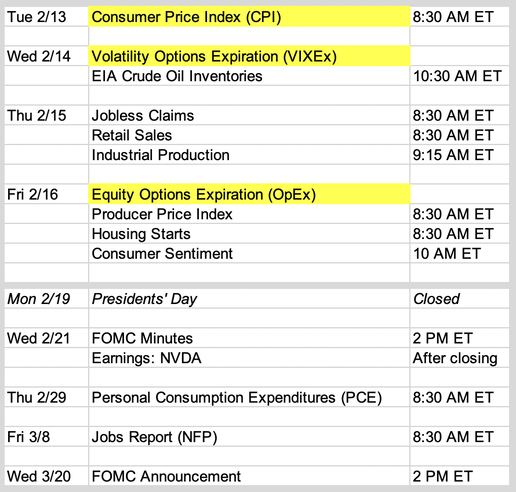

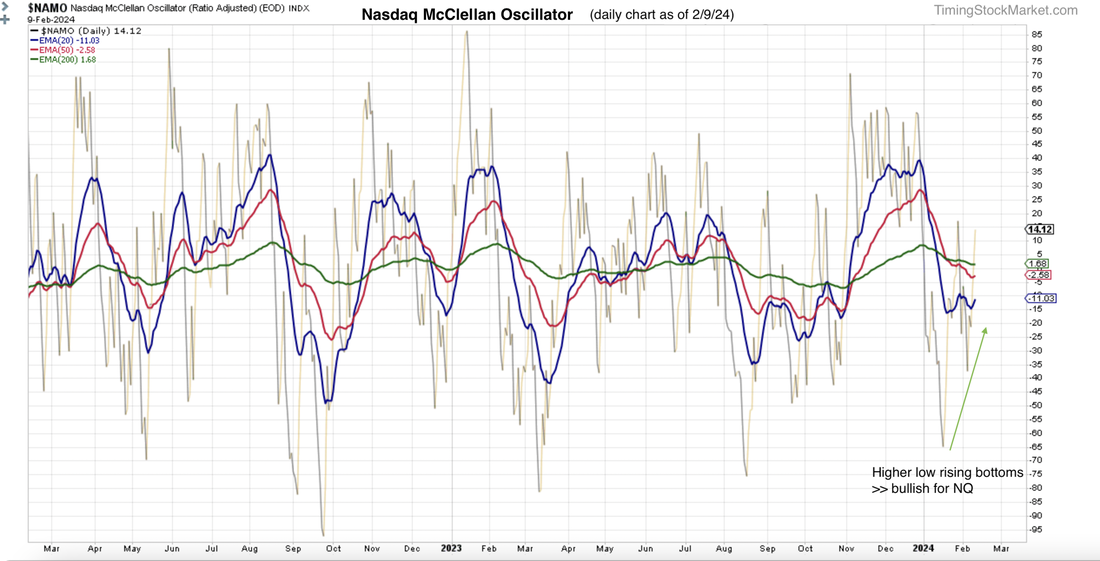

Updates 4 PM ET - Monday Tight stops protected our profit Bull Runner SOXL: On Wednesday Feb 7, we entered a half position of SOXL when NQ started breaking out. We have been holding this as a runner to capture NQ rising to 18200. (Today NQ reached 18122 and then dropped.) Bull Runner TNA: On Thursday Feb 8 , we re-entered a half position of TNA when RTY formed a big W bottom on its hourly chart. We held this as a runner to capture RTY rising to 2060. (Today RTY reached 2061 and then dropped.) Today VIX started rising sharply so per our discussion below, we tightened the stop and got stopped out of both TNA and SOXL for good profit when the afternoon selling kicked in. Updates 12:20 PM ET - Monday VIX is rising >> Choppy Bull emerging We posted earlier (see below) that we need to monitor for rising VIX and UVXY. VIX gapped up overnight and now they are both steadily rising this morning. This means the Strong Bull mode may be transitioning to Choppy Bull mode, with moderate dip as a possibility for ES NQ RTY. It won't happen right away but now is the time be cautious with our bull positions. We have been tightening stops on both our SOXL and TNA runner positions. SOXL got stopped out for a good sized profit. TNA is still intact and rising. Click here for Signal Trades spreadsheet. Updates 1:10 PM ET - Sunday Upcoming key events If you are into excitement, this is the week for you with plenty of economic news, along with VIXEx and OpEx. Market is sure to have some big moves. The question is what will they be. Read more economic analysis here, and read on. Strong Bull market mode continues Technically ES NQ RTY are back in Strong Bull mode, and this may continue until OpEx on Friday Feb 16. McClellan Oscillator for both NYSE and Nasdaq (Stockcharts.com $NYMO $NAMO) are showing higher low rising bottoms. This is very good news as it indicates that equity is coming out negative phase into the positive one. Once the positive phase start for $NYMO $NAMO, it can last 4-8 weeks. This strengthens the case for Strong Bull mode to continue. Volatility supports this Strong Bull mode as long as VIX keeps dropping. But if VIX forms a same low base around 11.8, then it's a signal that equity may be entering Weak Bull mode. In this mode, VIX is likely to climb back up to 15.2, possibly reaching 16.5 eventually. Weak Bull mode can lead to a big dip for ES NQ RTY. So keep an eye on what VIX does at this level. Keep an eye on UVXY also. If UVXY does not drop below 6.94 and instead starts to base early this week, then equity may be switching to Choppy Bull mode. Choppy Bull mode can may result in a moderate dip for ES NQ RTY. After the dip, we should see enough buyers coming back to turn the market into Strong Bull mode again. There is no setup for a Strong Bear market on the horizon right now. Key S/R levels NQ:

ES

RTY

Our personal trade plan 1. Bull Quick Profit SOXL: We will be looking for a shallow intraday dip to re-enter SOXL for a QP (Quick Profit) trade. 2. Bull Runner SOXL: On Feb 7, we entered a half position of SOXL when NQ started breaking out. As long as NQ remains in Strong Bull mode, we plan to hold this as a runner to capture NQ rising to 18300. 3. Bull Runner TNA: On Feb 8, we re-entered a half position of TNA when RTY formed a big W bottom on its hourly chart. As long as RTY remains in Strong Bull mode, we plan to hold this as a runner to capture RTY rising to 2097. Note that if we see the VIX W bottom or UVXY basing as discussed above, we'll manually exit all bull positions because the dip will knock out our positions. Click here for Signal Trades spreadsheet. Disclaimer The information presented here is our own personal opinion. Consider it as food for thought. We are not offering financial advice. We are not promoting any financial products. We are not registered financial advisers or licensed brokers. We make no guarantee that anything will unfold according to our projections. You are proceeding at your own risk if you follow our trades.

0 Comments

Leave a Reply. |

Archives

July 2024

Categories |

RSS Feed

RSS Feed